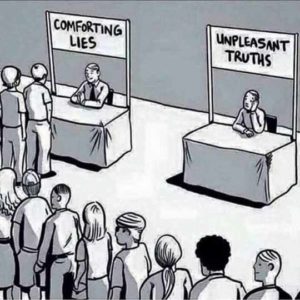

Many affluent people believe that they’re better off using their own money to self-insure long term care (LTC) needs. They view their savings and investments as their personal safety net, their rainy day fund. And yet, with all that financial preparation, they still can’t face the facts when their health declines and it becomes time to get extra care. Acknowledging the truth about your health is very emotional, no matter how much money you have.

Many affluent people believe that they’re better off using their own money to self-insure long term care (LTC) needs. They view their savings and investments as their personal safety net, their rainy day fund. And yet, with all that financial preparation, they still can’t face the facts when their health declines and it becomes time to get extra care. Acknowledging the truth about your health is very emotional, no matter how much money you have.

When You Self-Insure Long Term Care

The easy part is recognizing that you will, at some time in the distant future, need long term care. Choosing to fund these needs from personal savings could end up working against you.

- First of all, with no formal policy in place, how do you know when it’s the right time to start stepping up your level of care? Your long term care insurance has specific guidelines.

- Secondly, an LTC insurance plan provides a blueprint for your loved ones to follow. Without this blueprint, nobody really knows how much care you intended to receive.

- Even for the highly affluent, financial planners describe unplanned LTC costs as a dangerous “spending shock” that should be avoided.

Once you have a good LTC insurance plan in place, be sure to let your family know about it. Share your plans so they know what you want. Unnecessary sibling disagreements about money may be avoided.

Both affluent and non-affluent families suffer from postponing receiving the care that they need in their later years.

Here’s a great story by Christine Benz, who shares in her opening paragraphs how her parents could well afford to self-insure for long-term care (LTC), but her family denied the need!

Check out my testimonials page for examples of affluent and non-affluent families where LTCi ownership made a huge difference for the better.

I encourage you to avoid denial of your need for long term care! Use your LTCi as you originally intended: to prevent you from being a burden on those you love. Live out your life in comfort and grace!

Click here if you’d like a free quote on long term care insurance for you or someone you love.

Thanks for visiting my site! I like hearing from you!

Thanks for visiting my site! I like hearing from you!

Leave a Reply