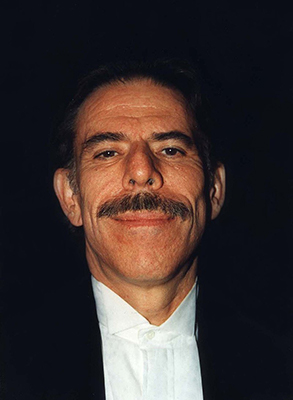

Many people have a fond place in their hearts for the art of Peter Max. A symbol of the hippie counterculture in the 1960s and 1970s, Max’s work holds prized locations on the walls of collectors around the world. Now in his later years, Peter Max has fallen victim to dementia. His wealth nor his notoriety can protect him from the financially abusive situation he has landed in.

Many people have a fond place in their hearts for the art of Peter Max. A symbol of the hippie counterculture in the 1960s and 1970s, Max’s work holds prized locations on the walls of collectors around the world. Now in his later years, Peter Max has fallen victim to dementia. His wealth nor his notoriety can protect him from the financially abusive situation he has landed in.

The courts are still sorting out the details of this twisted tale. Including lots of finger-pointing between his second wife, Mary Max (who died from suicide in June 2019), his son, Adam, and his daughter, Libra, along with the various lawyers, agents and guardians who were supposedly protecting Peter Max and his valuable business.

His Wealth Declined With His Health

The current state of Max’s condition is revealed in this article in the New York Times (May 28, 2019). The writer describes his lavish lifestyle and the popularity of his artwork. She also reports on the financial losses of his business and the questionable source of it’s latest recovery.

In 2012, Max’s health had rapidly declined and the dementia had taken a firm hold. Max was unable to work and finances suffered. The business, ALP Inc., defaulted on $5.4 million in bank loans. In exchange for half of his ownership in ALP, Max hired Lawrence Moscowitz, an insurance agent, to help breathe new life into the failing company. Moscowitz, in turn, appealed to Max’s estranged son, Adam, to actively manage the daily operations.

The revived business plan includes the hiring of “an expanding cast of artists to mimic Mr. Max’s more commercial work. In the acrylic-spattered space above the Chinese restaurant, according to seven people who have seen it, there were as many as 18 assistant painters…”

In six years, ALP transitioned from near-bankruptcy to generating over $93 million in sales. This is largely due to the aggressive exploitation of Peter Max’s reputation and his artistic style being sold as originals to unsuspecting consumers.

Where Was His Plan?

Peter Max’s business is now out of his hands, both artistically and financially. His family dynamics have deteriorated with the fight for guardianship between his wife and his children. Much of this could have been avoided by some thoughtful, advance planning and documentation. He could easily have provided for a formal succession plan. He could have selected his own guardian to look out for his interests in his later years.

Wealth is no protection against this type of failure. Oftentimes, the wealth only makes the fall more newsworthy. Stories about people protected from future illness by their long term care planning just don’t make the news.

You can take steps today to protect your future quality of life. Click here to receive your free, no-obligation quote for long term care insurance.

Thanks for visiting my site! I like hearing from you!

Thanks for visiting my site! I like hearing from you!

Leave a Reply